unified estate tax credit 2020

Qualified Small Business Property or Farm Property Deduction. What is the unified tax credit for 2020.

Taxation In The United States Wikiwand

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a.

. The unified tax credit is designed to decrease the tax bill of the individual or estate. The unified credit is a credit for the portion of estate tax due on taxable estates mandated by the Internal Service Revenue IRS to combine both the federal gift tax and estate tax into one. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E.

The basic exclusion amount for determining the unified credit against the estate tax will be 11580000 for decedents dying in calendar year 2020 up from 11400000 in 2019. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. In other words use it or lose it.

It mainly serves the purpose of preventing taxpayers from giving away too much during their lifetimes in order to avoid estate taxes. Estate tax exemption which may also be expressed in the form of a unified credit. Decedents dying in calendar year 2020 will be entitled to a 11580000 basic exclusion amount for the purposes of calculating the unified credit against the inheritance tax an increase from 11400000 in 2019.

You may be eligible to claim an adoption credit on your state tax return if you claimed an adoption credit on your federal tax return. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any amount above. The tax is then reduced by the available unified credit.

What is the unified tax credit for 2020. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. Get Your Max Refund Today.

The unified tax credit gives a set dollar amount that an individual can gift during their lifetime and pass on to heirs before any gift or. The Internal Revenue Service announced today the official estate and gift tax limits for 2020. What is the unified tax credit for 2021.

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. How Might the Biden Administration Affect the Unified Tax Credit.

The cap amount is 1206 million in 2022 up from 117 million in 2021. In addition to the unified tax credit individuals can give up to 15000 a year to a recipient or recipients 15000 per gift to as many recipients regardless of how many people you gift and not have to pay a gift tax. The 117 million exception in 2021 is set to expire in 2025.

The basic exclusion amount for determining the unified credit against the estate tax will be 11580000 for decedents dying in calendar year 2020 up from 11400000 in 2019. The exclusion amount in 2021 increased to 11700000. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

Estate tax exemption amount is US1158 million which if expressed as a unified credit amounts to US4577800. For 2021 the estate and gift tax exemption stands at 117 million per person. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. That number is used to calculate the size of the credit against estate tax.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Situs property transferred to your heirs Please contact us. For example lets say you give away 506 million in assets during your lifetime.

Non-resident aliens are entitled to a US estate tax unified credit of 13000 which exempts 60000 of property from estate tax. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The estate and gift tax exemption is 1158 million per. Youd have just 7 million left of that 1206 million credit with which to. This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples.

For example for 2020 the US. Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table. A key component of this exclusion is the basic exclusion amount BEA.

While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified. Any tax due is determined after applying a credit based on an applicable exclusion amount. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2020.

In 2020 after adjustment for inflation it was raised to 1158 million for individuals and 2316 million for a married couple. The previous limit for 2020 was 1158 million. The amount of the credit may be as much as 10 percent of the federal credit allowed per child or 1000 per child whichever is less.

To claim a portion of a US.

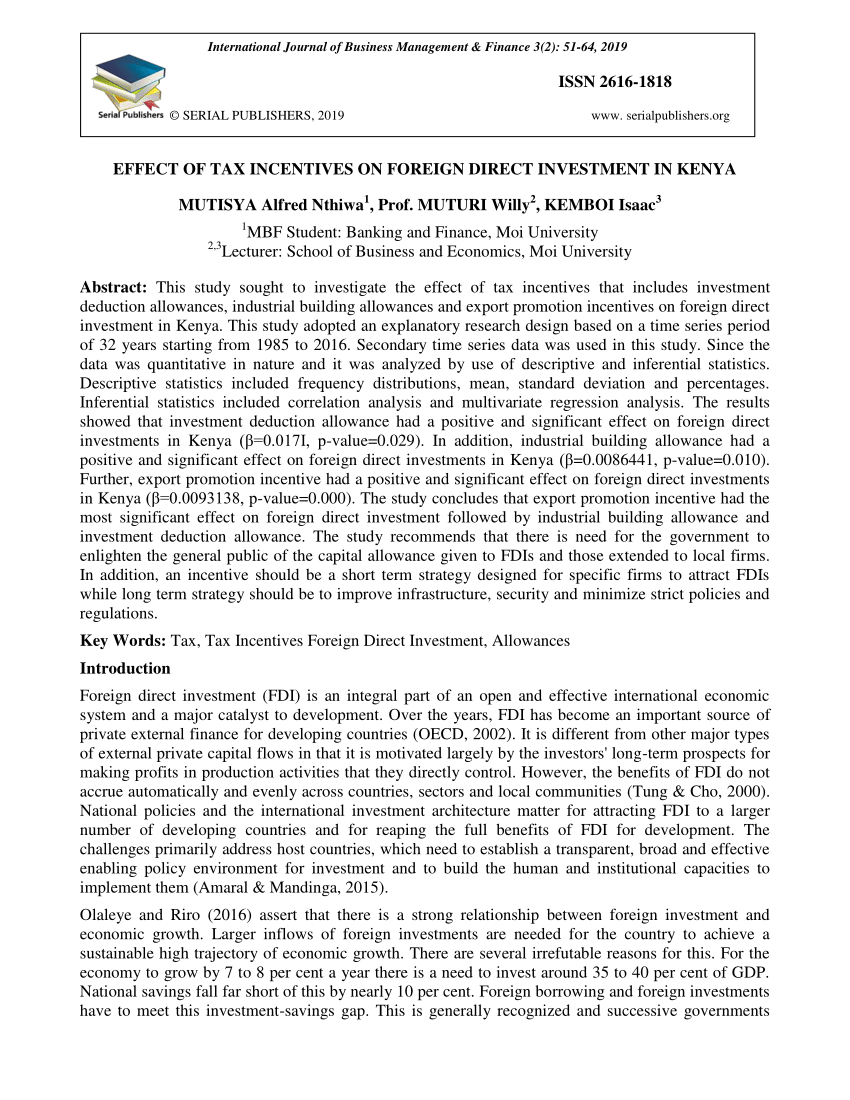

Pdf Effect Of Tax Incentives On Foreign Direct Investment In Kenya

How The Tcja Tax Law Affects Your Personal Finances

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances Allowance Tax Brackets Form

How The Tcja Tax Law Affects Your Personal Finances

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances Allowance Tax Brackets Form

U S Estate Tax For Canadians Manulife Investment Management

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

What Is The Unified Estate And Gift Tax Credit And How Does It Reduce My Gift Taxes

What S The Estate Tax Exemption For 2021 Legacy Design Strategies An Estate And Business Planning Law Firm

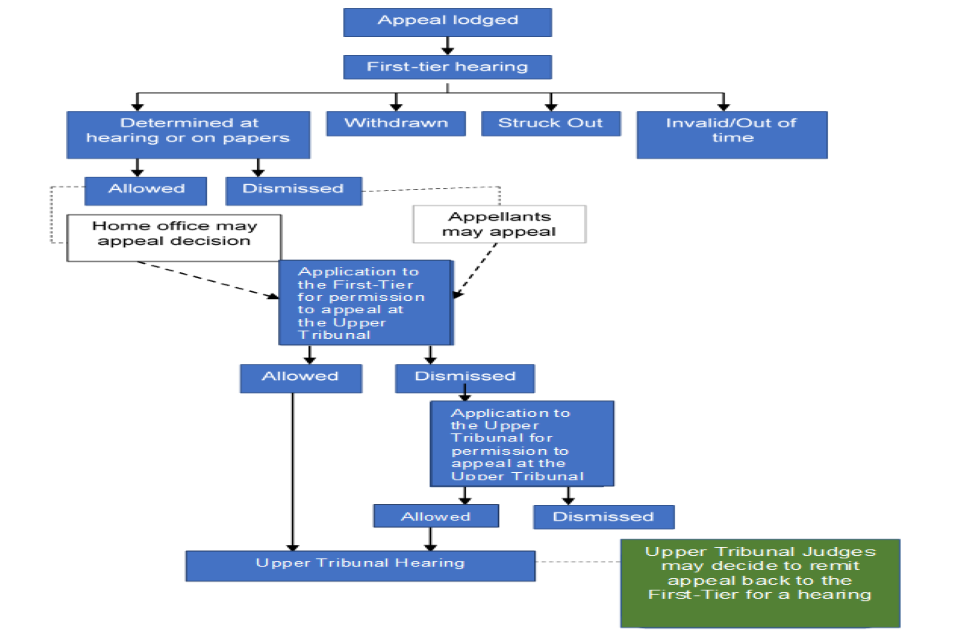

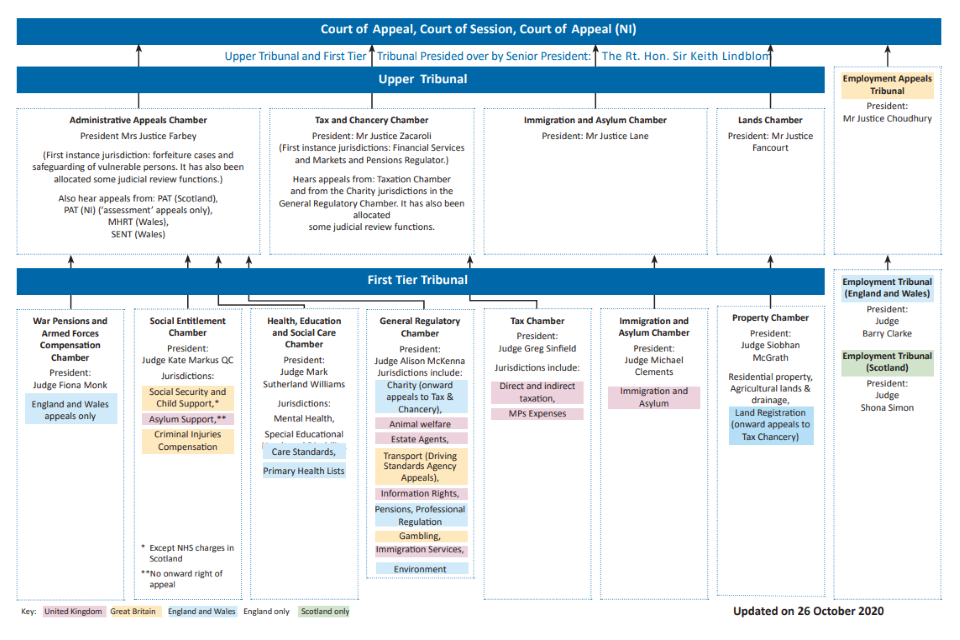

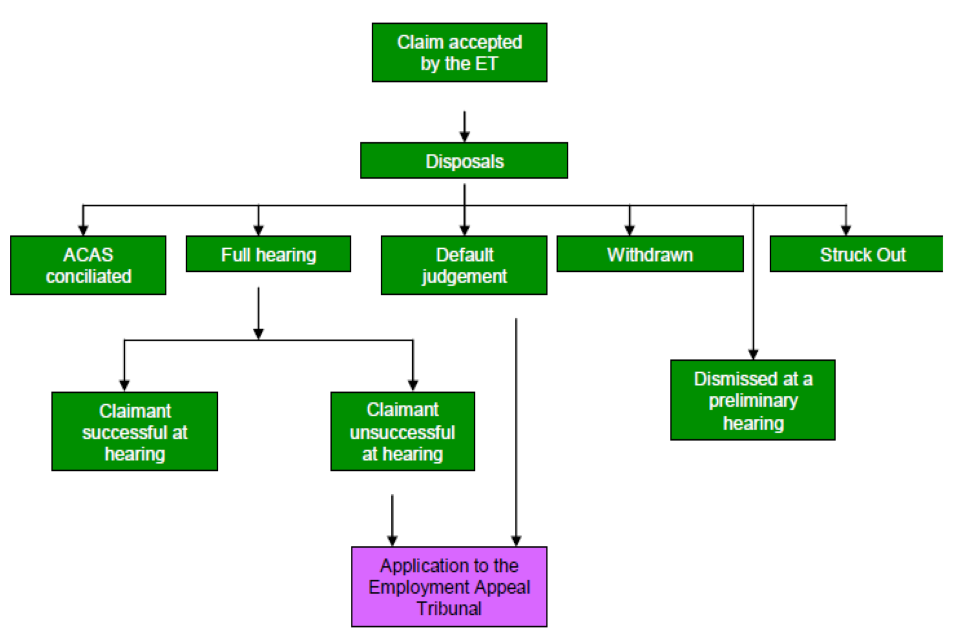

Guide To Tribunal Statistics Quarterly Gov Uk

Guide To Tribunal Statistics Quarterly Gov Uk